New Orleans carries a reputation for music, food, festivals, and culture that refuses to be copied anywhere else. Living inside that energy comes with a price tag, though one that surprises many people once monthly budgets are factored in.

Compared with major US cities, New Orleans often lands in a curious middle zone: cheaper than coastal giants, pricier than many Southern metros, and shaped by local conditions that make housing, insurance, and daily expenses behave a little differently.

What follows offers a clear, grounded look at how everyday costs in New Orleans compare with other American cities, with practical examples and real numbers woven throughout.

A Quick Snapshot of Overall Cost

Across national indexes, New Orleans typically ranks slightly above the national average for overall cost of living. In broad terms, New Orleans sits:

- Below are cities such as New York, San Francisco, Boston, Seattle, and Los Angeles

- Near cities such as Austin, Denver, and Atlanta

- Above cities such as Houston, Birmingham, Memphis, and Kansas City

While headline numbers help, daily life expenses tell a fuller story.

Housing Costs: The Biggest Variable

Rent in New Orleans

Housing shapes most personal budgets more than any other category. In New Orleans, rental prices fluctuate heavily by neighborhood, flood risk, tourism activity, and proximity to the French Quarter or major employment centers.

As of recent, typical market conditions:

| City | Average 1-Bedroom Rent (City Center) |

| New Orleans | $1,350 to $1,600 |

| Austin | $1,600 to $1,900 |

| Denver | $1,650 to $2,000 |

| Atlanta | $1,500 to $1,800 |

| Houston | $1,200 to $1,450 |

| New York | $3,000+ |

| San Francisco | $2,800+ |

Neighborhoods such as the Lower Garden District, Uptown, and Mid-City command higher prices. Gentilly and New Orleans East often remain more affordable, though commute times and insurance costs may rise.

Buying Property

Home prices in New Orleans vary sharply by block. Flood zones, hurricane history, elevation, and historic district rules influence pricing far more than in many inland cities.

Median home prices often land between $300,000 and $350,000, lower than Austin or Denver, higher than Houston or Memphis. Insurance becomes the hidden second mortgage. Homeowners frequently pay several thousand dollars per year for flood and hurricane coverage, adding a major long-term expense that many national averages overlook.

Utilities and Insurance: Where New Orleans Stands Apart

Electricity and Water

High summer humidity drives air conditioning use through much of the year. Electricity bills often exceed national averages, especially for older housing stock with limited insulation.

Monthly utility costs for a small apartment frequently range from $140 to $220, depending on the season. Large homes can exceed $350 per month during peak summer heat.

Insurance Costs

Insurance pushes the overall cost of living upward more than in most US cities.

Typical annual premiums:

- Homeowners insurance: $3,500 to $7,000

- Flood insurance: $600 to $2,000

- Windstorm coverage: varies widely by property and carrier

Comparable cities such as Atlanta, Dallas, and Nashville generally carry far lower insurance burdens.

Transportation Expenses

Car Ownership

Public transportation remains limited for many residential areas. Car ownership becomes essential for a large portion of residents.

Common monthly car-related expenses:

| Expense | Monthly Estimate |

| Car payment | $350 to $550 |

| Insurance | $160 to $240 |

| Fuel | $120 to $180 |

| Maintenance | $60 to $100 |

Insurance premiums in New Orleans rank among the highest in the South due to storm risk, theft, and accident rates.

Public Transit

A monthly transit pass costs far less than in coastal cities, yet coverage gaps limit its usefulness for commuters outside central neighborhoods.

Food and Groceries

Grocery pricing sits slightly above national averages. Tourism and shipping patterns influence food costs, while abundant local seafood offsets some categories.

Average monthly grocery costs for one adult:

- New Orleans: $350 to $450

- Atlanta: $300 to $400

- Houston: $280 to $380

- New York: $450 to $600

Dining remains one of New Orleans’ greatest joys, though frequent restaurant meals add up quickly. Local eateries often remain more affordable than major coastal cities, especially for high-quality cuisine.

Healthcare Expenses

Healthcare costs align closely with national averages. Hospital systems and specialist access mirror those found in other midsize metros. Health insurance premiums reflect statewide risk pools rather than city-specific factors.

Out-of-pocket expenses for basic care and prescriptions rarely exceed comparable costs in Austin, Atlanta, or Denver.

Taxes: The Louisiana Factor

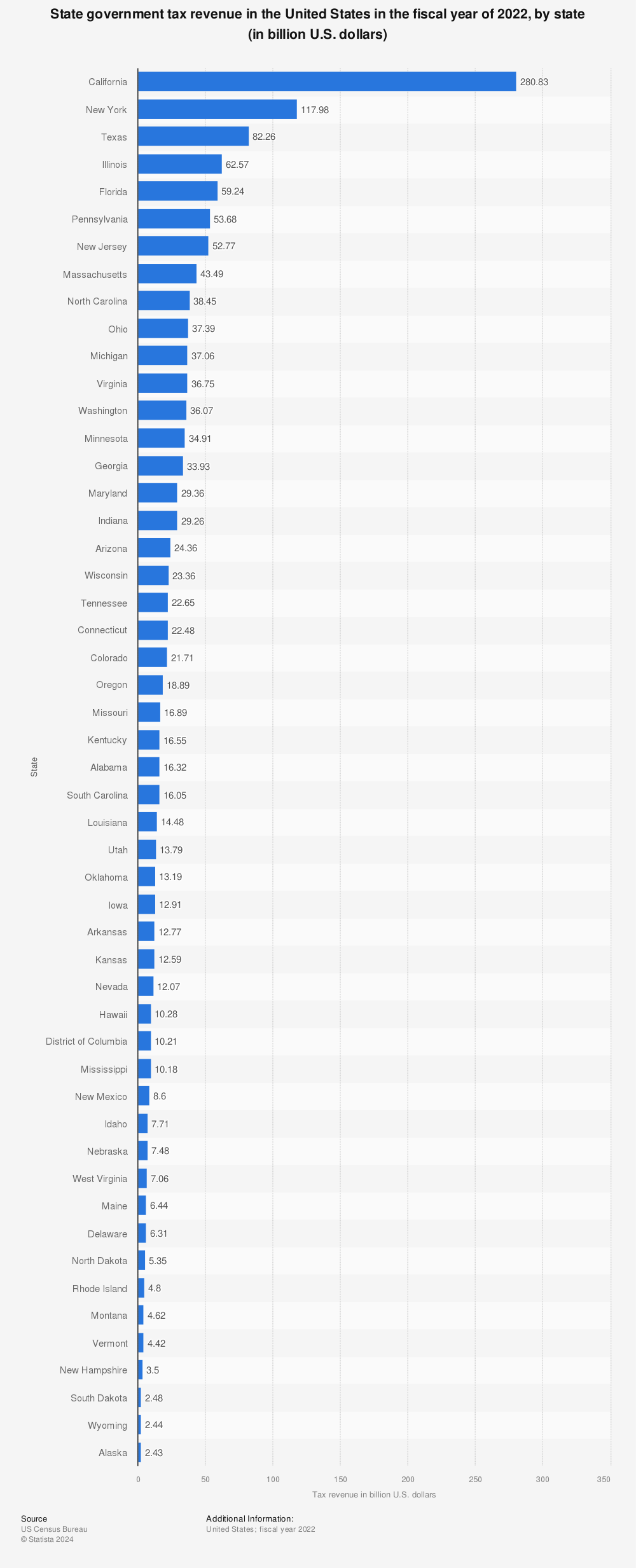

Find more statistics at Statista

Sales Tax

Combined city and state sales tax rates exceed 9 percent in many areas of New Orleans, among the highest in the nation. For everyday purchases, residents feel the impact immediately.

Property Tax

Property tax rates remain relatively low compared with many states, though insurance and maintenance costs often outweigh any advantage.

Income Tax

Louisiana’s income tax rates sit in the middle range nationally. Residents coming from Texas, Florida, or Tennessee experience a noticeable shift after relocation.

Lifestyle Costs and Entertainment

New Orleans entertains at nearly every budget level.

| Category | Typical Monthly Cost |

| Gym membership | $40 to $90 |

| Live music cover | $10 to $25 |

| Cocktail at neighborhood bar | $7 to $12 |

| Festival season spending | Highly variable |

Many residents spend less on entertainment than their counterparts in Los Angeles or New York, simply due to local culture emphasizing affordable social experiences.

Comparing With Selected US Cities

New Orleans vs Austin

Austin’s housing prices have surged faster. Insurance remains far cheaper. Utility bills remain similar. Food and entertainment pricing stay comparable.

Overall, monthly budgets often come out slightly lower in New Orleans for renters, higher for homeowners once insurance enters calculations.

New Orleans vs Houston

Houston remains more affordable overall. Housing and insurance both cost less. Utilities and transportation remain similar. Sales tax stays slightly lower.

New Orleans vs Denver

Denver’s housing costs exceed New Orleans by a wide margin. Utilities remain similar. Insurance costs remain much lower. Overall,l monthly expenses usually remain higher in Denver.

New Orleans vs Atlanta

Atlanta offers similar housing costs with lower insurance. Transportation costs remain similar. Sales tax rates remain slightly lower. Atlanta often lands marginally cheaper overall.

New Orleans vs New York and San Francisco

No contest. Coastal giants carry housing costs that dwarf New Orleans, even after accounting for insurance and utilities.

Income Levels and Purchasing Power

Median household income in New Orleans lags behind many peer cities. That dynamic amplifies financial pressure for many households. Residents frequently stretch budgets more tightly than counterparts in Austin or Denver due to lower wages across several sectors.

Remote work has shifted some dynamics, with higher earners relocating from expensive metros and finding New Orleans relatively affordable by comparison.

Real Monthly Budget Example

Single renter in Mid-City:

| Category | Monthly Cost |

| Rent | $1,450 |

| Utilities | $190 |

| Groceries | $400 |

| Transportation | $520 |

| Health insurance | $420 |

| Phone and internet | $140 |

| Entertainment and dining | $300 |

| Miscellaneous | $180 |

| Total | $3,600 |

An equivalent lifestyle in Denver often exceeds $4,200. In Houston, closer to $3,200.

Long-Term Financial Planning in New Orleans

Prospective residents should plan for:

- Larger emergency funds for storm recovery

- Higher insurance deductibles

- Seasonal spikes in utility bills

- Rising property insurance volatility

Housing Market Language and Documentation

View this post on Instagram

Real estate contracts, insurance policies, zoning rules, and flood certifications involve heavy technical language. Anyone reviewing contracts or policies often seeks tools that rewrite dense text into a more digestible form. A helpful resource appears in many financial planning workflows, a paraphrasing tool that allows residents to clarify policy language while evaluating housing decisions.

Who Thrives Financially in New Orleans

New Orleans tends to suit:

- Remote professionals earning salaries pegged to higher-cost regions

- Dual-income households with stable employment

- Homeowners who purchased before the recent insurance surges

- Entrepreneurs tied to tourism, hospitality, or creative industries

Households with variable income or heavy insurance exposure often feel the financial pressure more acutely.

Looking Ahead

Climate risk, insurance markets, and infrastructure investment will continue shaping New Orleans’ cost profile. While housing remains more accessible than in many booming metros, long-term affordability depends heavily on insurance reform and wage growth.

Final Thoughts

New Orleans occupies a unique financial space among American cities. Monthly expenses rarely reach coastal extremes, yet insurance, utilities, and income levels push budgets tighter than many Southern counterparts. For residents drawn by culture, community, and daily rhythm, the financial equation often feels worth managing with care and preparation.